- REVERSE MORTGAGE CALCULATOR MONTHLY PAYMENTS UPGRADE

- REVERSE MORTGAGE CALCULATOR MONTHLY PAYMENTS DOWNLOAD

All investing comes with risk, including the risk of loss.

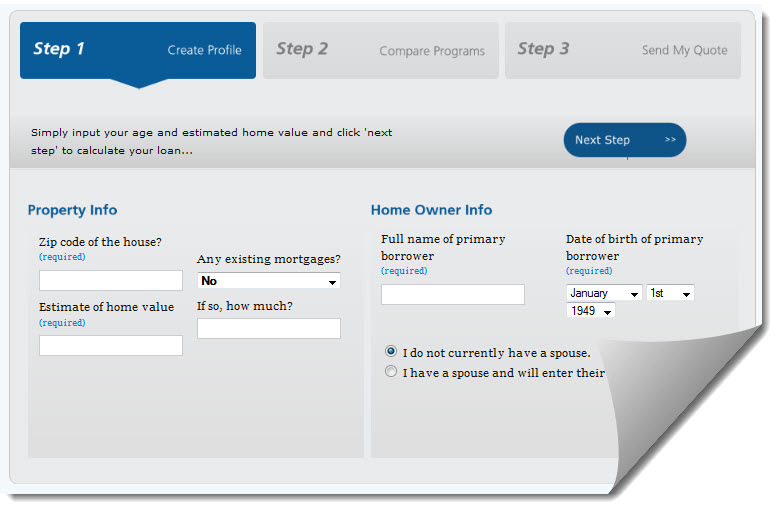

Past performance does not guarantee future results. Two choices: Term (fixed monthly payouts for a set number of years) or Tenure (fixed monthly payouts as long as you maintain the reverse mortgage and the payout does not cause the balance to exceed the amount stated in the mortgage). Neither personalized nor tailored services should be construed as a guarantee of a particular outcome. Get a set monthly payout to supplement your income. If website visitor makes use of the reverse mortgage calculator contained within or linked to this site, he or she acknowledges that the information resulting from the use of any such calculator is intended to be used for illustrative and educational purposes only and is not, and should not be construed, as the receipt of, or a substitute for, personalized individual advice from Retirement Researcher, LLC or from any investment professional. Not all services will be appropriate or necessary for all clients, and the potential value and benefit of the adviser’s services will vary based upon a variety of factors, such as the client’s investment, tax, and financial circumstances and overall objectives. You can find a list of our lender members by clicking here.Inclusion of the reverse mortgage calculator on this page should not be construed as advice or recommendations regarding the appropriateness of a reverse mortgage to a viewer’s individual circumstances. As rates naturally fluctuate, they impact the percentage of your home equity which you can borrowfor example, the lower the interest rate, the more cash that’s available. The National Reverse Mortgage Lenders Association (NRMLA) is not a licensed lender or broker and does not make or offer loans. Unlike a traditional mortgage, a reverse mortgage does not require monthly mortgage payments 1. Upon choosing a lender and applying for a HECM, the consumer will receive from the loan originator additional required cost of credit disclosures providing further explanations of the costs and terms of the reverse mortgages offered by that originator and/or chosen by the consumer. You might find reverse mortgage originators that offer higher or lower margins and various credits on lender fees or closing costs. Reverse Mortgages have become popular as a new source of income and with record breaking real estate values it is little wonder why. The lender will add a “margin” to the index to determine the rate of interest actually being charged. Reverse Mortgage Calculator: Estimate How Much You Can Borrow If the user inputs an amount exceeding 625,500, this pops up: 'HECM loan amounts are based on a maximum property value of 625,500, even if your home is worth more.

The “index” (our calculator uses the Monthly Adjusted LIBOR, which is a common index used in the market) will adjust regularly, as market interest rates move up or down. to 55 of the value of your home in tax-free cash Remain in the home you love and make no monthly mortgage payments. Interest rates on variable rate HECM loans are comprised of two components, an index and a margin. Lenders might also offer different options on interest rates and fees. Note these closing costs can and do vary by geographic area or region.

The rates and fees shown are not the actual rates you might be offered by any particular lender, but generally represent rates that may be available in the market today, with the maximum origination fee allowable under HUD rules reflected for illustrative purposes only, along with an estimated FHA Mortgage Insurance Premium for a loan based upon the home value provided, and estimated recording fees and taxes, and other types of closing costs typically associated with a reverse mortgage loan. It is intended to give users a general idea of approximate costs, fees and available loan proceeds under the FHA Home Equity Conversion Mortgage (HECM) program. Our reverse mortgage experts are here to answer all your questions.

REVERSE MORTGAGE CALCULATOR MONTHLY PAYMENTS UPGRADE

By speaking on the phone, we can upgrade the estimate into a more precise loan summary customized to your needsfree of charge.

There are several options available to you for accessing your home equity.

REVERSE MORTGAGE CALCULATOR MONTHLY PAYMENTS DOWNLOAD

Please note: This calculator is provided for illustrative purposes only. DOWNLOAD NOW Give us a call to confirm the estimate you receive.

0 kommentar(er)

0 kommentar(er)